Long dependent on manual procedures, the insurance sector has suffered delayed response times, mistakes, and inefficiencies in handling claims. But the way artificial intelligence (AI) and automation are developing will drastically change how insurance claims processing is done going forward. Offering many advantages to both providers and consumers, AI-Powered Claims Automation seeks to transform the way insurance firms handle and process claims.

Fastness and Effectiveness

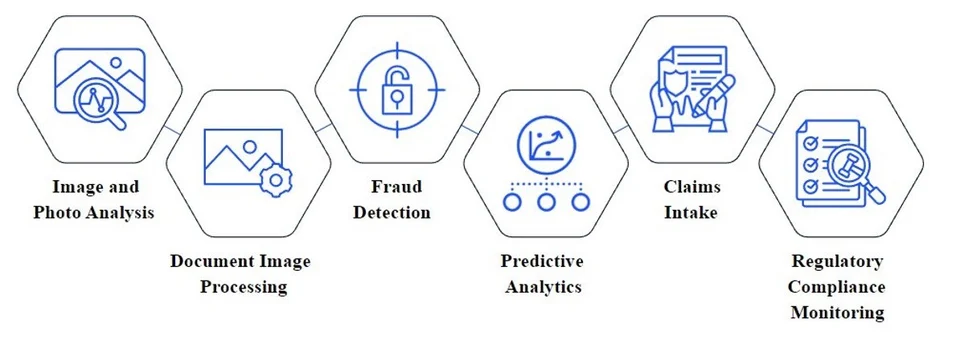

The speed claims are handled, offering one of the most important benefits of AI-powered claims automation. As human agents personally evaluate claims, confirm information, and compute compensation, traditional claims handling might take days or even weeks. Many of these chores can be performed in real-time with artificial intelligence, therefore drastically lowering the time required to resolve a claim.

Accuracy and Minimal Mistakes

Any industry has human mistakes; insurance is not an exception. Errors in claim processing could cause expensive delays, conflicts, and unhappy consumers. By means of algorithms to evaluate claims depending on predefined criteria, AI-powered claims automation reduces the chance of mistakes. Over time, machine learning models keep getting better, so enhancing their capacity to evaluate claims more precisely.

Cost Reductions for Policymakers

Additionally, major cost savings for insurance companies could result from artificial intelligence-powered automation. Insurance businesses can cut the requirement for human involvement in low-level operations by automating typical chores such as data entry, document verification, and first claim assessments.

Improved consumer experience

AI-powered claims automation is about boosting the customer experience as much as it is about raising operational efficiency. AI-driven claims processing guarantees speed and accuracy that guarantees policyholders are not left in the dark for protracted lengths of time. Real-time updates on the state of a claim made by automated technologies let consumers monitor their claim and feel more informed all through the process.

Verification of Fraud

For insurers, insurance fraud is a major issue that causes higher expenses for policyholders and businesses alike. Through pattern and anomaly identification in claims data that can point to fraudulent conduct, artificial intelligence can assist in reducing this risk.

The Journey Ahead

Claims automation’s advantages in the insurance sector will only get more apparent as artificial intelligence technology develops. From quicker claims processing to better accuracy and more consumer happiness, artificial intelligence is poised to transform insurance going forward.

Ultimately, by bringing speed, accuracy, and cost savings as well as a better experience for consumers, AI-Powered Claims Automation is poised to transform the insurance business. Further innovation driven by this technology will help to create a more customer-friendly insurance ecosystem for years to come as it develops.